Funds Europe presents the findings from its survey with RBC Investor & Treasury Services to assess the industry’s state of preparedness for Ucits V.

6. Were you aware that Ucits V was going to require these cash monitoring rules?

There is roughly a 75/25 split in the responses to the awareness of cash monitoring rules, with almost a quarter of firms (21.5%) admitting that they were not aware that Ucits V would contain cash monitoring rules, as is the case with the AIFMD. We can only speculate if this answer is representative of a wider lack of preparedness among this 21.5% or restricted to the cash monitoring issue. Additionally, it remains to be seen how much work this minority will have to do to prepare for this cash monitoring measure.

INDEPENDENT DIRECTORS 7. What will Ucits V mean for the availability of independent directors?

7. What will Ucits V mean for the availability of independent directors?

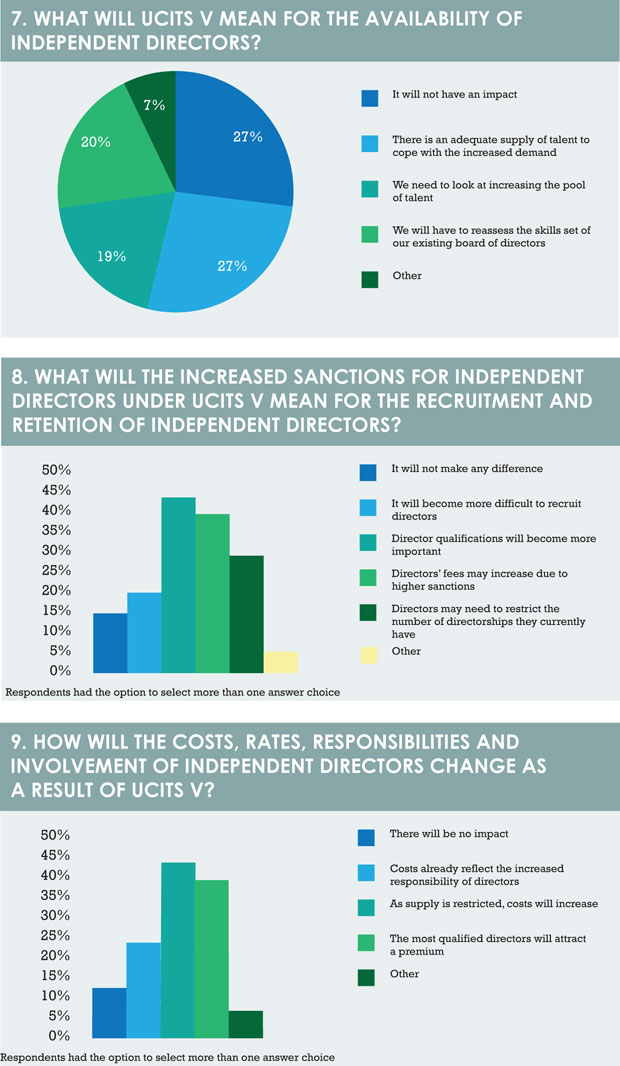

One concern that has been voiced is that by imposing greater responsibility on the role of independent directors, asset managers will find it harder to recruit them. The survey results seem to show a somewhat even split. The majority believe that it will either have no impact (27%) or that there is an adequate supply of directors to cope with the demand (also 27%). Nevertheless, this still leaves a significant minority that are concerned and believe the pool of talent should be widened (18.9%) and the skills of their existing directors should be reassessed (20.3%).

As with some of the previous questions, some managers will be unaffected by the change in directors’ roles and responsibilities because they may already have a majority of independent non-executive directors in their boardroom. Another comment made was that “we are OK but we feel that there is an industry shortage”. Of particular concern to one respondent is the fact that the separation of directors for Management Companies and Depositaries will require a board reorganisation, including the independent board members.

8. What will the increased sanctions for independent directors under Ucits V mean for the recruitment and retention of independent directors?

There is little difference between those respondents that expect the retention and recruitment process to become harder (21.6%) and those that think there will be no difference (16.2%). A much greater number, though, expect the recruitment process to become more rigorous, with more focus on directors’ qualifications (47.3%). And a similar number (43.2%) expect directors’ fees to go up, given that they will need to restrict the number of directorships they hold – it is likely that they will resign from either high-risk funds or less remunerated directorships. In addition to the fees, there will also be higher insurance costs for Directors & Officers cover (whether this is paid for by the firm or by the director).

9. How will the costs, rates, responsibilities and involvement of independent directors change as a result of Ucits V?

Examining the impact on costs in more detail, the greatest number of respondents (43.1%) believe that a shortage of supply will be the biggest catalyst for increasing cost, while a similar number (38.9%) expect there to be a premium for the most qualified. However, almost a quarter (23.6%) believe that the greater responsibilities facing directors as a result of Ucits V are already reflected in the costs (and a further 9.7% believe that there will be no impact).

10. Will insurance be mandatory for all independent directors and if so, how will it be covered?

10. Will insurance be mandatory for all independent directors and if so, how will it be covered?

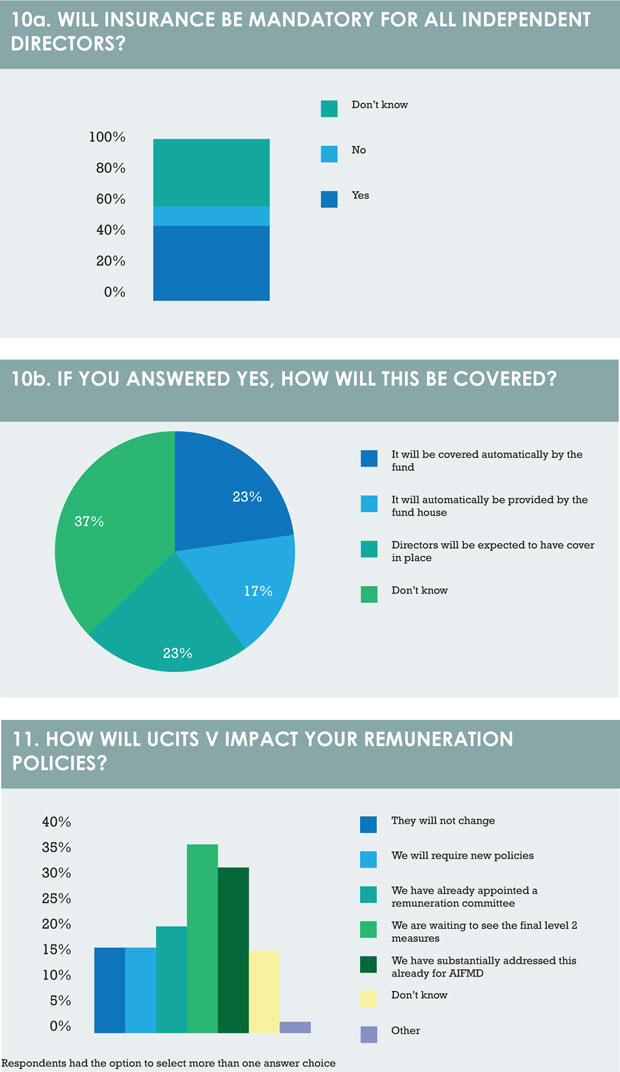

The final question deals with the issue of insurance for directors – something typically covered by Directors & Officers policies which cover the liability facing boardroom executives. Just over half of the respondents (52.7%) believe this insurance will be mandatory and just a small number take the opposite view (6.8%) leaving the remainder unsure (40.5%). There is greater uncertainty as to who will finance the cover, with an equal number (23%) saying that the directors will be covered by the fund or, conversely, that directors will be expected to provide their own cover. The biggest percentage of respondents (36.7%) simply said they don’t know, all of which suggests that that is an area where greater clarity needs to be provided.

REMUNERATION

11. How will Ucits V impact your remuneration policies?

The answers to the questions around remuneration show just how varied the level of preparedness is among firms, especially question 11. Tellingly, there are once more an equal number of respondents taking opposite approaches to the issue, with 15.9% believing that they will require new policies and the same number believing there will be no change. The most prominent answer (34.8%) is that firms are waiting to see the final Level 2 measures, however a similar number (30.4%) believe they have substantially addressed the issue through the AIFMD.

12. How will the Ucits V anticipated remuneration rules affect you?

12. How will the Ucits V anticipated remuneration rules affect you?

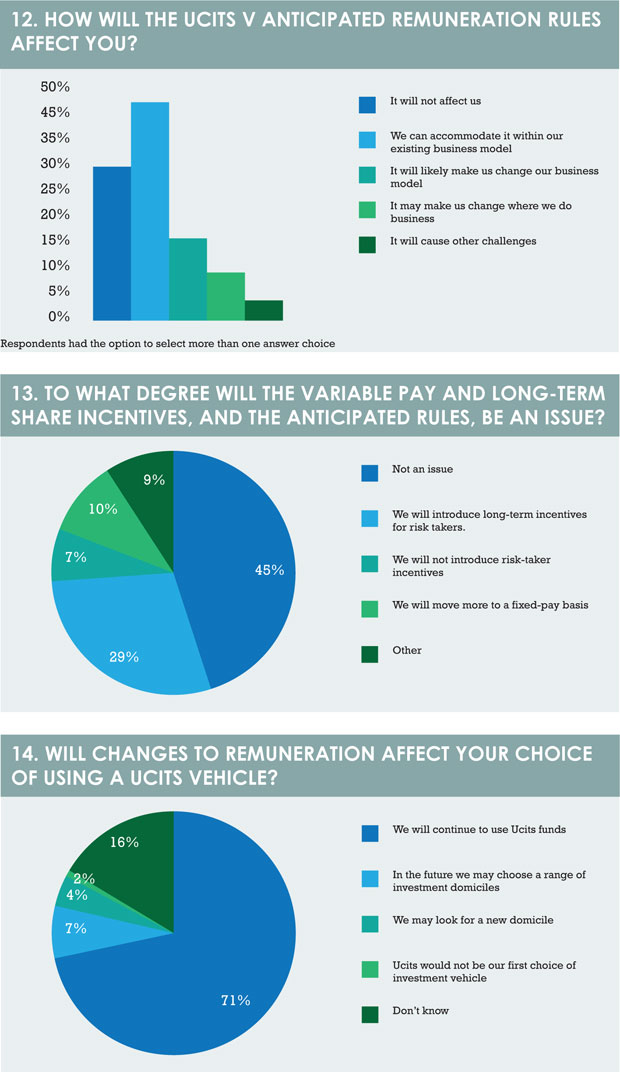

Three-quarters of firms are confident that the likely rules will either be of no effect (29.0%) or can be easily accommodated within the existing business model (46.4%) while just over a quarter think that it will either necessitate a change of business model (17.4%) or a change of domicile (10.1%). While these latter responses are in the minority, the sentiments are significant, especially the prospect of a geographic change, presumably outside of the EU. The geographical issues were also expressed by one respondent who pointed out the difficulty posed by having staff in the same business unit located both inside and outside the EU in Brisbane and London. “The rules affect different individuals within the same team but equity considerations mean we need to look at how this should apply to everyone.”

13. To what degree will the variable pay and long-term share incentives, and the anticipated rules, be an issue?

Almost half of respondents (44.9%) say this will not be an issue. For those that do anticipate some changes, the most popular measure will be to introduce long-term incentives for risk (29%), while 10.1% will move to a more fixed-pay basis. Of those that opted for the ‘other’ option, half were unsure, one stated that change was already in place and one said that their approach would be dependent on the detail and interpretation of the rules. Just one respondent has already implemented changes.

14. Will changes to remuneration affect your choice of using a Ucits vehicle?

As regards remuneration, the question of most consequence is answered with a resounding majority. An overwhelming number (71%) will continue to use Ucits funds, while a much smaller number may consider using a wider range of investment vehicles. Yet, given the importance of Ucits funds to so many asset managers and their investors, the fact that 15.9% are still unsure about their continued use of Ucits should be cause for some concern on two levels – one, that Ucits may become too costly an investment vehicle, and two, that a number of firms feel they do not yet know enough about Ucits V to make a definitive statement on such an important issue.

©2015 funds europe