The credit crunch is biting ever deeper into the fund management industry. Fiona Rintoul looks at what managers must do to survive and finds that targeting customers in Asia and selling traditional funds may be part of the answer.

Efama (the European Fund and Asset Management Association) put a positive spin on its 2007 year-end statistics, which were published recently: European investment fund assets grew by almost €400bn to reach €7.9 trillion at 31 December.

“This positive development could be achieved despite net outflows from Ucits funds in the third and fourth quarters of 2007, which reflected heightened risk aversion among European investors,” the association said in its year-end statistical release.

But the broader truth is that the figures were harsh. At just €170bn, total net sales of Ucits for the year were down €282bn on the 2006 total of €452bn – a lower level even than in 2002, the previous annus horribilis, when they reached €207bn.

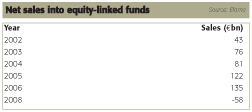

Equity (see chart below) and bond funds recorded annual net outflows last year of €58bn and €60bn respectively, while in 2002 they managed net inflows of €43bn and €41bn.

“2007 will go down in asset management history as its worst year on record, beating even 2002 for this dubious accolade,” said the research firm Lipper Feri, which takes a blunter approach to damage assessment.

“2007 will go down in asset management history as its worst year on record, beating even 2002 for this dubious accolade,” said the research firm Lipper Feri, which takes a blunter approach to damage assessment.

Lipper Feri’s figures, which are calculated slightly differently from Efama’s, also paint a bleaker picture. The research firm put net annual sales at just €87bn. “Without the input of institutional liquidity flows, Europe would have ended the year with a net redemption total of €60bn,” it said in the analysis of its year-end data.

The estimated net sales data produced by Lipper Feri were indeed a source of much sobering ask-not-for-whom-the-bell-tolls gloom and doom in the second half of 2007, with headlines ranging from Sub-prime fallout crushes equities, to Europe turns red!

The August estimated figures revealed the biggest monthly net redemptions ever recorded in Europe (€70bn), while “a further rout in December removed an additional €56bn, dragging the full year sales total down to just €87bn – half the volume posted in 2002 when collapsing stock markets caused Europe’s fund asset base to drop by 5%”.

It’s not cheery stuff. But we’ve seen it all before, haven’t we? Market tremors followed by substantial outflows? Not quite. “The problems are worse now than in 2002,” says Diana Mackay, CEO of Lipper Feri, “because it taints every asset class.”

Cash flow

Rising interest rates punished bonds, with Lipper Feri recording particularly strong outflows in the mainland European markets of Italy, Germany and Spain where bond funds have traditionally formed the bedrock of portfolios. And even money market funds didn’t survive unscathed. Institutional inflows may have kept the figures respectable – Efama puts annual net inflows at €46bn – but money market funds were not the safe haven of choice for retail investors.

“Most investors are going into cash,” says Mackay. “Right now you can get 5-6% on deposit accounts, so it’s hard to argue you should be in something else. On top of that, banks want to keep people in deposit accounts to increase their reserves.”

Perhaps the most complete losers are enhanced money market funds. “Money market ‘enhanced’ and ‘dynamic’ funds suffered from concerns about the risk exposure of these funds to asset-backed securities, as investors reassessed their portfolio composition in light of the credit crisis in the second half of 2007,” says Efama.

Their future, suggests Mackay, is bleak. “Enhanced money market looks quite vulnerable. It’s hard to see that sector making a comeback quickly.”

It’s a fairly comprehensive rout, then, with few bright spots. Emerging market funds attracted inflows in the dying months of 2007 – “the one bright spark in an otherwise dull trading month for long-only products was a positive return of €7bn in equities, fuelled entirely by the expanding emerging market bubble,” as Lipper Feri put it in its deconstruction of October sales data – but even they began to falter after the new year.

Lipper Feri’s January 2008 data are just as depressing as what went before. Despite a “tidal wave of investment” in money market funds, again dominated by institutional money, amounting to €82bn or “three times the volume of Europe’s last money market record set in January 2002”, the European industry ended the first month of 2008 in the red.

“The money market surge was extraordinary but it failed to offset exceptional withdrawals from other fund categories, which were sufficient to leave the European industry €2bn in deficit,” commented Lipper Feri. “Every other asset class slumped into negative territory with equities leading the retreat.”

In fact, net outflows from equity funds totalled €56bn, more than double the previous record set in November 2007. “In one month, [outflows] wiped out half the sales successes posted in 2006,” said Lipper Feri.

The one category with reasons to be cheerful is ETFs. As the beneficiaries of hedge funds shorting the indices, they saw €6bn of inflows. “Longer term there are various forces in the market, mainly rising out of MiFID, that open the door to ETFs wider,” says Mackay. “Brokers and IFAs don’t sell ETFs because they don’t make any commission on them, but the approval of an institutional share class means they can wrap a fee-generating product around them.”

The question now is: Who is best placed to survive in the challenging environment that lies ahead?

For Andy Maguire, senior partner in the London office of the Boston Consulting Group, it’s almost a little too early to ask this question. The dust, he suggests, has yet to settle. “There’s a lot of noise, but I’m not sure what the real signal is,” he says.

The shock to the system has been of such unprecedented dimensions that it’s hard to draw the normal kind of generalist versus specialist conclusions – perhaps because the crisis affects just about everyone.

Mackay suggests that proprietary fund houses are, in some ways, best placed to survive the crisis because “they have ready access to bank clients”. On the other hand, as she herself concedes, the banks are currently pushing those clients into bank deposit accounts rather than funds.

The maths of selling mutual funds don’t work so well,” says Maguire. But at the same time he wonders how long banks that own mutual fund companies can leave them, as it were, unfed. “If they decide they want to keep going, they have a sales force to support and they need to give them something to do,” he says.

Is it easier, then, for smaller, specialist groups? Not really. “If you’re a small shop, the chances are you don’t have such good risk management,” says Maguire. “You’re also more likely to be reliant on one asset class or product.”

It may well be time to tear up the rulebook and start again – or at least put it to one side. For if there is one clear lesson that has come out of the sub-prime crisis it is this: don’t place undue reliance on process. Even under the most extreme stress test, suggests Maguire, some of the events that have taken place would never have been guessed at.

“I think there will be a big change in the risk culture,” says Maguire. “It won’t be so much about process and systems. We’ve just had a great big lesson in less process and more culture. We need to focus on whether or not we understand what we’re doing.”

This is a kind of back-to-basics outlook. The firms that will succeed will be those with a keen understanding of the nuts and bolts of investment, and forget the twiddly bits.

Experience counts

“At times like this you have to let go of the models a bit,” says Maguire. “There’s a premium on experience. You don’t have to throw the models away, but you want people who have experience and can be flexible, who can use analytical tools but aren’t hidebound by them.”

Investors will come back to funds. Peter de Proft, director-general of Efama, suggests that in the early part of this year flows in Europe will be dominated by money market funds and capital-protected products. Then markets may calm down and there will be something like a return to normal. “Investors will move out of short-term products into more traditional products, such as bond and equity funds,” he says.

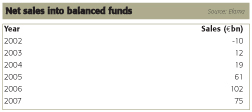

In this light, it is notable that among the Efama fund sales figures, balanced funds saw healthy inflows in 2007 (see chart below).

Newton Investment Management, the asset manager owned by The Bank of New York Mellon, says the balanced style of multi-asset investing has fallen out of favour for “no good reason”. Iain Stewart, director of investment management at Newton, says that in the past year all of Newton’s multi-asset funds have outperformed their benchmarks, as well as over the past three-, five-, and ten-year periods.

In a European context, de Proft also emphasises the increasingly important role being played by flows from Asia. Efama’s analysis says: “Assuming Asian economies continue to expand at a steady rate, Ucits should continue to attract strong net inflows from Asia, as investors there are still in the early phases of diversifying their savings into investment funds.”

Even if Europe is in the doldrums, the European industry may be sustained by investment from elsewhere. “The Ucits brand is really recognised now,” says de Proft. “The fact that the ICI is thinking about developing the same type of product is testimony to that.”

Lipper Feri’s Mackay is similarly optimistic for the long term. The crisis is “fairly deep and fairly aggressive”, but there is light at the end of the tunnel. Much of the disinvestment seen in Europe over the past year has not been a desperate flight to safety, she suggests, but profit-taking.

“Retail investors started to come out in May 2006, and there’s been a slow dribble since then,” Mackay says. “Most of these people have been coming out when the going is good, and if that’s the case there won’t be any long-term damage.”

The sector to suffer the biggest outflows in January, for example, was European Equity (-€13bn). But this was also the sector to have registered some of the biggest sales gains (over €19bn in 2005 alone). The investors coming out will have benefited from performance increases of 30% or more since then.

Mackay’s thesis is that there’s a wall of money building up that will come back into funds once the market calms down and it is strategically sensible for banks to guide clients back into mutual funds. “When interest rates fall and the banks are no longer worried about their reserves they will have greater interest in putting clients into funds,” she says.

Between now and then expect a squeeze that will probably be slightly painful for everyone, and very painful for some. “A lot of people will go out of business because they can’t survive the crisis,” says Maguire.

Knowing who those people will be is difficult. Recent months have seen some surprising re-evaluations of asset management companies. The Lipper European Fund Awards in March saw the Belgian firm Petercam, normally something of a stranger to international award ceremonies, take the award for best overall large promoter in Europe. Meanwhile, Deutsche Bank analysts were trashing the likes of UK-listed New Star, until recently a stellar returns generator.

“We are fundamentally negative on New Star’s business model and growth prospects in the current market environment,” writes analyst Chantal Moshal in a March 2008 research note. Moshal cites high exposure to equities and commercial property in the business mix, deteriorating performance, high operating margins and a tumbling share price as reasons to mark New Star a ‘sell’.

Interestingly, in her notes on New Star, Moshal highlighted the flip side of employee share schemes – a key plank of remuneration in boutiques and boutique-like structures within larger firms – which is that your effective remuneration goes down with your employer’s star when share prices start to fall.

“This presents serious staff compensation and retention issues for the group,” notes Moshal, “as equity-related compensation … are [sic] a key tool for maintaining high operating margin levels.”

For the moment, Moshal’s investment firm of choice is UK-listed Man Group. As one of the only sizeable quoted hedge fund managers, Man Group’s valuation “fails to capture management’s excellent track record for delivering consistent growth in earnings, coupled with the positive outlook for hedge fund growth”.

New period of consolidation

But who knows what next year will bring? Perhaps it all just illustrates what Mackay calls the Primary Law of Mutual Funds: what goes in must come out. “Groups that make big sales in one year build up legacy assets that are then vulnerable to be lost,” she says.

Both Moshal and Maguire predict that we are about to enter a new period of consolidation. Moshal says this will be driven by the need to separate manufacturing and distribution, as exemplified by the Legg Mason/Citigroup transaction where Citigroup sold its manufacturing arm to Legg Mason in return for a cash/stock payment and Legg Mason’s distribution platform.

“There is a growing regulatory risk to banks/insurance companies in their dual involvement in both product manufacturing and distribution,” says Moshal. “To address this risk there is increasing evidence of separation of the manufacturing and distribution functions.”

Where all this will leave us is uncertain. “Right now, most participants in the industry are somewhere between relieved and petrified, but not sure where the whole thing will finish up,” says Maguire.

© funds europe 2008