The case for investing in China is a compelling one, says Margaret Harwood-Jones, Global Head, Securities Services, Transaction Banking at Standard Chartered.

Macroeconomic volatility is increasing, fuelled by the economic consequences of Brexit; record low interest rates; commodity swings; and political risk in the US. Many international investors would have included China’s recent market unpredictability in that list, but these events have been exaggerated.

China offers international investors solid return opportunities at a time when decent returns are far and few between. The UK, for example, is predicted to have GDP growth of 1.2% in 2016 and 0.5% in 2017, according to estimates by Standard Chartered Global Research. Real GDP growth in the US increased to 1.2% in the second quarter of 2016. Very few major markets therefore have predicted growth rates of 6.5% as China does, and foreign asset managers ought to take note.

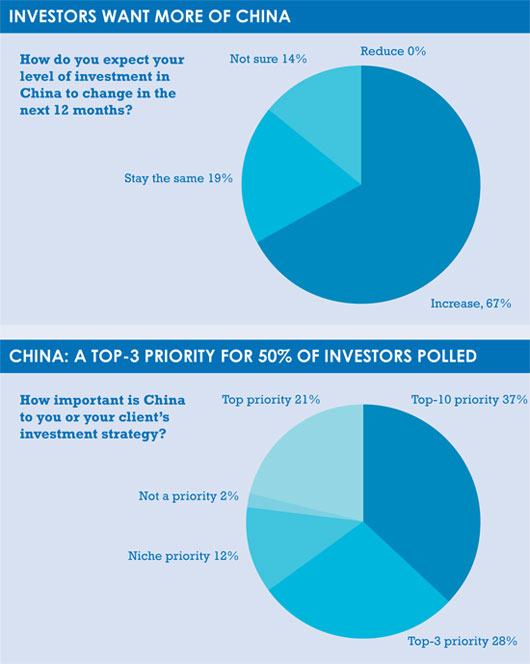

Research in May 2016 by Standard Chartered – ‘RMB Investors Forum White Paper: Rise of Next Generation China Access’ – indicates there is healthy foreign investor interest in China, and it is growing. Sixty-seven per cent of investors said they planned to increase the level of their investments in China within the year, while 62% are confident the investment environment in China will improve in the next 12 months. Not a single respondent said they would reduce their China exposure.

Simultaneously, almost half of respondents said they were confident they would be able to attract new funds from clients to China in the next year.

These promising trends have been abetted by regulators, who are steering on a path of market liberalisation. This has included more generous quota allocations for foreign investors through the Qualified Foreign Institutional Investor (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) schemes.

These promising trends have been abetted by regulators, who are steering on a path of market liberalisation. This has included more generous quota allocations for foreign investors through the Qualified Foreign Institutional Investor (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) schemes.

Easier access for Hong Kong-based investors, including fund managers, has been enabled following the introduction of Stock Connect. Stock Connect allows for two-way investment between Shanghai and Hong Kong in what will boost liquidity in China A-shares.

Efforts have been made by the Chinese regulator to make investing into the country through Stock Connect easier through the introduction of same-day Delivery Versus Payment (DVP). This will reduce counterparty risk at asset managers. Shenzhen’s stock exchange will now be linked to Hong Kong too.

Other exchanges may follow, including regional APAC markets and possibly the UK.

LIBERALISING THE BOND MARKET

One of the most exciting developments has been the additional liberalising measures around China’s $7.4 trillion Interbank Bond Market (CIBM). CIBM was opened to major foreign investors in 2015 but curtailed to public institutions such as Central Banks and Sovereign Wealth Funds (SWFs). This has since changed, and now asset managers can invest into the CIBM. This will help boost liquidity on the mainland and it is a further step towards the internationalisation of the RMB. While MSCI did not incorporate China in its global benchmark indices, there are hopes this will happen in due course given the pace of reform.

As market liberalisation continues, asset managers are becoming ever more comfortable with the established practices around rolling out new regulations in China. Standard Chartered’s research indicates that market participants are willing to accept these existing practices.

That said, all affected financial institutions agree that greater clarity and communication from regulators is key for the growth of existing and future market access mechanisms in China. Speed to market for new channels is still slower than many would like, driven by a time lag in adoption, whether by regulators and/or asset managers’ legal and compliance departments, a point made in the Standard Chartered paper.

The paper acknowledged global rules such as UCITS V had raised the bar on due diligence requirements, which meant that each market change in China is routinely costing more for man hours and legal fees for foreign investors.

But the focus for asset managers should not just be about investing into China but winning mainland clients. China has a fast-growing middle class with a rising disposable income. China has historically been cut off from foreign managers, but this has been changing over the last 18 months.

Mutual Recognition of Funds (MRF) was finally introduced in July 2015, allowing funds in Hong Kong which meet certain eligibility criteria to sell into China, and vice versa.

MRF has proven more popular among mainland managers looking to distribute into Hong Kong, though. Administrative challenges have stymied adoption by Hong Kong managers, and interest has been somewhat limited. Just 8% of respondents to the Standard Chartered survey confirmed they were using MRF, although 16% said they would consider it. This is reason to be positive, and indicative that as asset managers attain better understanding of MRF, there will be greater uptake.

FOREIGN INTEREST

The Qualified Domestic Limited Partnership Programme (QDLP) – which launched in 2013 – permits hedge funds to sell to high-net-worth individuals (HNWIs) in Shanghai. Again, there were restrictions such as capital-raising limits, but interest was there, as evidenced by the volumes of regulatory applications by foreign managers.

However, reports in the Financial Times in February 2016 indicated that QDLP quotas had been mothballed following fears in Beijing of an exodus of capital out of the country. Restricting capital outflows into foreign hedge funds was one of the weapons in the armoury of Chinese regulators to prevent further depreciation of the RMB during the market volatility.

China offers asset managers a number of opportunities, both in terms of investing and winning mandates. China is a market that cannot be ignored by managers and their service providers any longer, particularly given the continuing market volatility elsewhere in the world.

©2016 funds europe