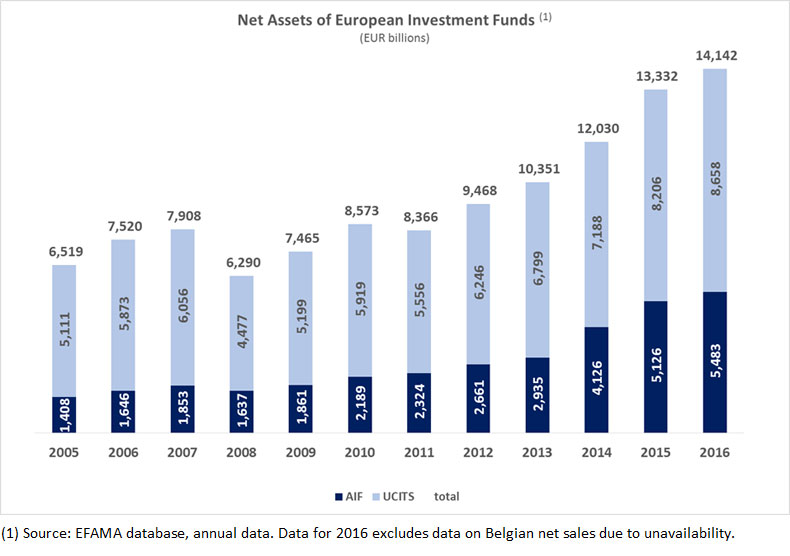

The net assets of European investment funds rose to a record high of €14,142 billion last year despite a steep drop in year-on-year sales.

Investment fund assets increased by 6.1%, which included a 5.5% net increase in Ucits assets to €8,658 billion.

Assets in regulated alternative investment funds (AIFs) rose 7% to €5,483 billion partly on the back of their best-ever sales of €184 billion, up from €148 billion in 2015, according to European Fund and Asset Management Association (Efama) figures.

The association blamed a major stock market sell-off in January 2016 for the net fall in sales of Ucits investment products, which more than halved from €590 billion in 2015 to €275 billion last year.

“After three years of constantly increasing net sales, multi-asset funds suffered a sharp fall in net sales in 2016 as investors tried to limit their direct and indirect exposure to stock markets,” Efama said in its full-year results for 2016.

Efama added that after a difficult first quarter, bond funds “enjoyed a strong rise” in net inflows on the back of falling long-term interest rates and that higher uncertainty and renewed downside risks continued to increase the demand for money market funds despite very low returns.

Cross-border Ucits funds based in Ireland and Luxembourg attracted 69% of total Ucits net sales, while AIFs based in Germany accounted for 53% of the total net sales of regulated alternative funds.

Despite the drop in net sales of Ucits funds in 2016, they were – at €275 billion worth of sales – still higher than in any single year from 2007 to 2013, when the annual average nets sales of Ucits investment products was €189 billion.

©2017 funds europe