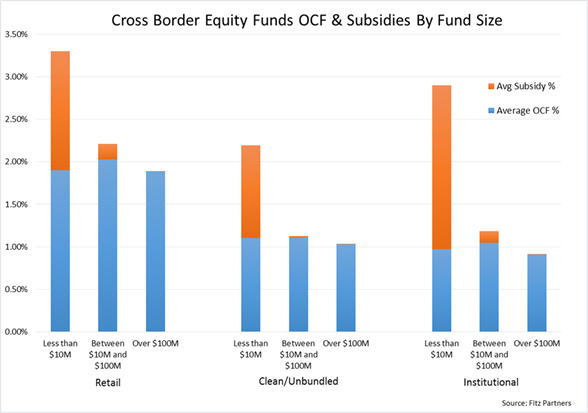

The vast majority of asset managers (79%) subsidise their own funds to keep total charges under control, according to research published this week.

A survey by the independent research firm Fitz Partners of cross-border fund charges also found that 19% of recorded subsidies exceed fund management fees.

Fitz estimates that 24% of the largest asset managers with cross-border funds distributed in Europe are currently applying a fee caps policy to at least one range of funds.

Funds with fee caps show on average very similar management fees than funds without caps but higher operating expenses before subsidy. When comparing operating charges figure (OCF) or total overall operating charges paid by investors, funds with fee caps in place show a lower level of OCF.

Funds with fee caps show on average very similar management fees than funds without caps but higher operating expenses before subsidy. When comparing operating charges figure (OCF) or total overall operating charges paid by investors, funds with fee caps in place show a lower level of OCF.

Hugues Gillibert, chief executive of Fitz Partners, said: “Equity funds with expense caps show on average lower OCF by 11 basis points, but this competitive edge comes at a price to asset managers who are often forced to heavily subsidise their fund products.”

Earlier this month Fitz published research that showed the average performance fee charged by European cross-border funds had dropped from 20% to 16%.

©2017 funds europe