Indians have traditionally invested in gold and property, but the country now has 50.6 million mutual fund investors, and they can expect a good return from equities, says Praveen Jagwani, CEO of UTI International Private Limited.

The reasonable man adapts himself to the world; the unreasonable one persists in trying to adapt the world to himself. Therefore all progress depends on the unreasonable man. – George Bernard Shaw

Balancing long-term objectives with the pressing need to demonstrate short-term results is a challenge that torments individuals, families, corporations and nations alike. Yet, the frenetic zeal and pace with which Indian prime minister Narendra Modi has gone about unleashing reforms is perhaps one of the better examples of an unreasonable man persisting within the stranglehold of a modern democracy. Being born into poverty, and possessing a reputation for being incorruptible, has enabled him to capture the imagination of the people, even though his reform agenda has met with middling success.

In the first three years of his administration, Modi has launched a variety of campaigns. These include: Clean Indian Mission (to raise awareness of health and hygiene); Make in India (to generate sustainable employment); Smart Cities (modern infrastructure-enabled cities to reduce the burden on the main metros); Jan Dhan (financial inclusion for the poor, which has seen 270 million no-frills bank accounts opened); Suraksha Beema (low-cost insurance coverage, with 100 million new policies issued); and Rural Electrification (which aims for all Indian villages to get electricity by December 2017).

GOOD TRACK RECORD

I’m sure the Modi government hopes that the socio-economic impact of these bold moves will be visible just in time for the next general election in 2019, and return it to power for another five years. With only two years to go, it is unlikely that unpopular objectives like labour reform will now be pursued. On the external front too, Modi has built a good track record. He has managed to attract $46 billion (€43 billion) of foreign direct investment across sectors in 2016 and engineered the passing of the Goods and Services Tax (GST) bill, as well as the Corporate Bankruptcy bill. This is a remarkable achievement, given that he does not have an absolute majority in both houses of parliament. He is also known to carefully monitor the Ease of Doing Business metric and the Global Competitiveness Index for India.

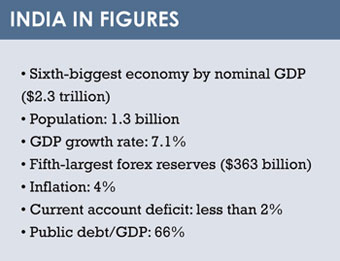

By all accounts, India today is on a vastly improved trajectory, the best since independence. All macroeconomic indicators point to a fast-growing, resilient economy, within the context of emerging markets. Despite all the positive hype, India remains an emerging economy and this fact was driven home during the recent demonetisation exercise.

By all accounts, India today is on a vastly improved trajectory, the best since independence. All macroeconomic indicators point to a fast-growing, resilient economy, within the context of emerging markets. Despite all the positive hype, India remains an emerging economy and this fact was driven home during the recent demonetisation exercise.

The lofty objective of weeding out undeclared wealth (estimated at 2% of GDP) was punctured by the operating level corruption within the banking apparatus that allowed the biggest offenders to exchange their old notes for new by the truckload. To add insult to injury, the disruption of everyday trade due to a paucity of cash clearly had a negative impact on consumption and discretionary spending.

However, there has been positive fallout as well. The estimated $230 billion cash deposited in Indian banks as a consequence of demonetisation can now be lent, unleashing a credit multiplier.

Also, the people who have deposited large quantities of cash will now be subject to tax scrutiny, leading to higher tax collection, thereby unleashing a fiscal multiplier. Indeed, in the latest budget, the projection for fiscal spending has increased without a significant increase in government borrowing.

Since exports are less than 14% of India’s GDP, the country remains to some degree insulated from the vagaries of the global environment. Still, India’s economy moving into a higher gear will, to an extent, depend on a global revival. There has been a historically high correlation of India’s GDP growth with US growth. Presently, the capacity utilisation in Indian manufacturing remains around 70%. This needs to reach 78%-80% levels before an investment cycle can commence.

Meanwhile, we expect that with greater financial inclusion and job creation, over time prosperity will return to rural India, leading to markedly higher spending patterns. In fact the 2017 budget focused on rural spend, housing schemes and tax cuts for the lower income groups. There is also an expectation of more social schemes for poverty alleviation, leading to greater consumption.

EQUITY MARKETS

With erosion of deposit rates, an ever-increasing number of people have been drawn to the equity markets. Domestic mutual funds added 1.64 million new customers during the last quarter of 2016, bringing the total number of investors to 50.6 million, according to the Association of Mutual Funds of India (AMFI).

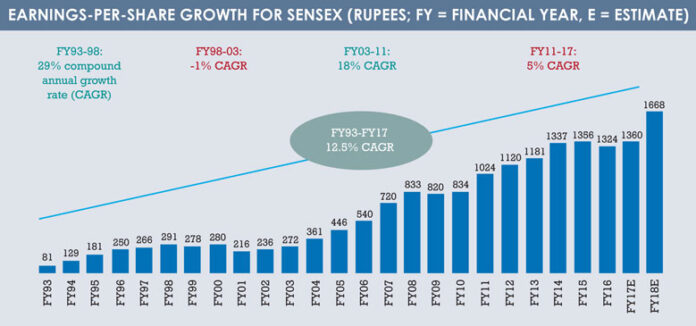

Historically, Indians have had a predilection for physical assets, with a substantial portion of their savings being invested in gold and property. However, the impact of globalisation, urbanisation and demonetisation in varying degrees has contributed to a gradual shift to financial assets such as stocks and bonds. In 2016 alone, the domestic mutual funds industry grew by 25% to reach assets under management of $250 billion. This shift to financial assets is the single biggest reason that despite a global ‘risk-off’ trade during the second half of 2106, the Indian equities remained resilient. India remains a stock-picker’s paradise, with many sectors growing at upwards of 20%. As reforms kick in and consumption picks up again, we are optimistic about a strong performance from the Indian equity market in 2017-18.

©2017 funds europe