Cost is one of the main reasons ETF usage is increasing and investors spend as much time evaluating passive investments as they do active. The Edhec-Risk Institute’s Felix Goltz and Véronique Le Sourd explain their findings.

The increasing use of exchange-traded funds (ETFs) was identified by the ninth Edhec-Risk Institute survey of European investment professionals on the usage and perceptions of ETFs conducted at the end of 2015.

ETFs make up an increasing proportion of portfolio holdings across asset classes and satisfaction has remained at high levels, especially for traditional asset classes. There has been a significant increase in satisfaction with equity ETFs, which now enjoy a satisfaction rate of 98%, compared to 91% in 2014.

The satisfaction rates for ETFs based on the most liquid asset classes are far more consistent compared to those based on illiquid asset classes. Investors also recognise the high quality of ETFs when compared to competing indexing vehicles.

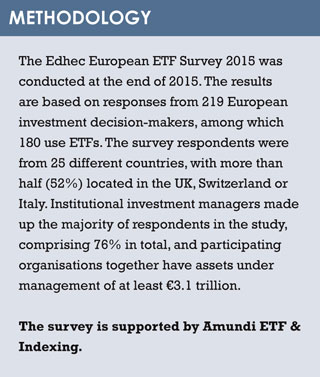

In terms of ETF demand, cost considerations appear to be the main driver behind increasing ETF allocations. Increases are also motivated by performance, transparency and liquidity. ETFs are seen mainly as a substitute for active management, but 75% of respondents think that smart beta indices provide significant potential to outperform cap-weighted indices in the long term. More than 81% think that the use of smart beta indices means avoiding cap-weighted indices that are concentrated in very few stocks or sectors.

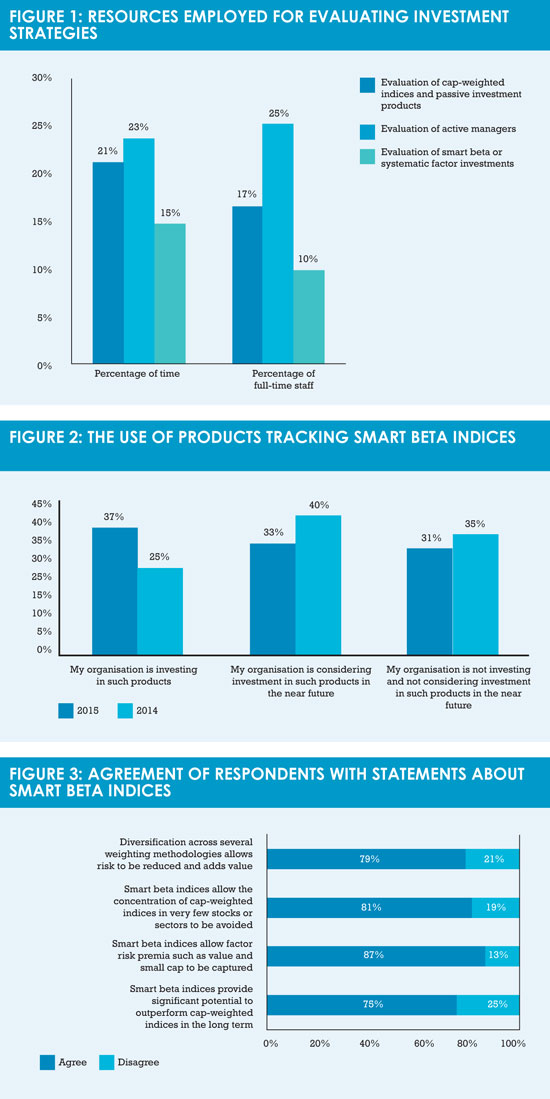

As far as evaluation challenges are concerned, investors allocate most resources to the appraisal of active managers, fewer resources to the evaluation of cap-weighted indices, and even fewer to the assessment of smart beta.

The vast majority of respondents (94%) agree that smart beta indices require full transparency on methodology and risk analytics. Transparency is not only the best protection against the risks arising from conflicts of interests, but it is also instrumental in improving the informational efficiency of the indexing industry. There is a considerable gap between investors’ information requirements for smart beta and accessibility of information from providers.

In this article, we focus on the relative means and resources devoted to evaluating passive investments compared to active investments, and the perceptions of smart beta ETFs.

ACTIVE VERSUS PASSIVE INVESTMENTS

One interesting finding was that investors dedicate more resources to evaluating active management than indexing or smart beta products. While respondents spent a comparable percentage of their time evaluating passive management and active managers (21% and 23% respectively), they spent only 15% of their time evaluating smart beta and systematic factor investments.

Figure 1 indicates the average percentage of time personally spent by respondents on evaluating passive investment, active managers and smart beta or systematic factor investments, respectively, as well as the percentage of full-time staff personally involved in the evaluation of passive investment, active managers and smart beta or systematic factor investments, respectively.

Figure 1 indicates the average percentage of time personally spent by respondents on evaluating passive investment, active managers and smart beta or systematic factor investments, respectively, as well as the percentage of full-time staff personally involved in the evaluation of passive investment, active managers and smart beta or systematic factor investments, respectively.

Differences are even greater with regard to the percentage of full-time staff involved in evaluating the different forms of investment. While 25% of full-time staff are dedicated to the evaluation of active managers, only 17% of full-time staff are employed for the evaluation of cap-weighted indices and passive investment products, and only 10% for the evaluation of smart beta or systematic factor investments.

It is striking that the highest resource allocation is given to the evaluation of active managers. Indeed, evaluation of cap-weighted indices and passive investment products receives less time and fewer staff than evaluation of traditional active managers.

Moreover, a striking gap exists between the resources allocated to smart beta evaluation and the resources allocated to evaluating either traditional active management or traditional passive management products. Resources allocated to smart beta product evaluation clearly lag behind. With the increase in the number of smart beta products, more resources should be needed to evaluate the various offers. However, our results suggest that investors do not necessarily have adequate resources for smart beta, which is a more recent phenomenon and constitutes a new category in between traditional passive and active management.

SMART BETA ETFS

For the third year, our survey includes information on respondents’ use of products tracking smart beta indices. It appears from the results that investors continue to show high and still increasing interest in smart beta ETFs.

More than a third of respondents (37%) already use products tracking smart beta indices, compared to 25% in 2014, and another third (33%) do not currently invest in such products but are considering investing in them in the near future (see Figure 2). These results imply that we are likely to see strong growth in the usage of smart beta ETFs in the future.

In addition, ETFs based on smart beta indices top respondents’ concerns with regard to developments in the future, with 38% of respondents desiring further developments.

This broad use of ETFs based on smart beta indices, as well as the wishes for additional development, may be explained by the favourable perception that respondents have of smart beta indices as tools for improving their investment process, as shown by their answers to further questions.

This broad use of ETFs based on smart beta indices, as well as the wishes for additional development, may be explained by the favourable perception that respondents have of smart beta indices as tools for improving their investment process, as shown by their answers to further questions.

As displayed in Figure 3, three-quarters of respondents (75%) think that smart beta indices provide significant potential to outperform cap-weighted indices in the long term and more than four respondents out of five (81%) think that they avoid cap-weighted indices being concentrated in very few stocks or sectors.

About the same proportion of respondents (79%) thinks that diversification across several weighting methodologies allows risk to be reduced and adds value, while 87% of respondents agree that smart beta indices allow factor risk premia, such as value and small-cap, to be captured.

These results show there is strong agreement from respondents with the conclusions from research on the potential benefits of smart beta.

Felix Goltz is head of applied research and Véronique Le Sourd is senior research engineer at the Edhec-Risk Institute

©2016 funds europe