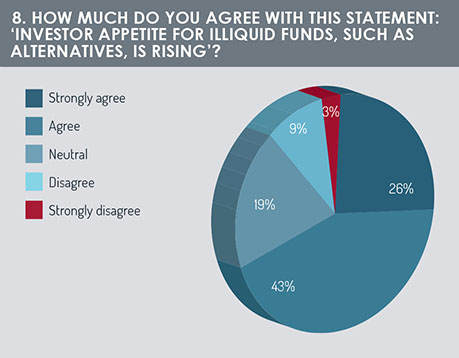

After the 2008 financial crisis, when memories of lock-ups and frozen assets were still fresh, illiquid funds were shunned. Not so in 2018. A clear majority (69%) of respondents said that investor appetite for illiquid funds, such as alternatives, was rising, of which more than a quarter strongly agreed with the statement (see figure 8). For better or worse, investors are much happier than in the past to invest their money in assets that cannot quickly be sold. For purveyors of real estate, private equity and infrastructure funds, this is an encouraging trend.

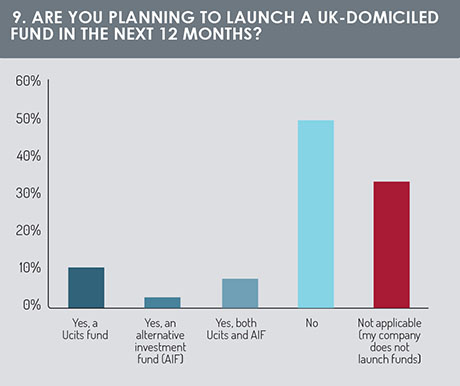

But, for those companies that are considering launching funds, where will the products be domiciled? Given the ongoing uncertainties surrounding Brexit, some have speculated that asset managers will avoid the UK as a domicile. It is true that relatively few of our respondents are considering launching UK-domiciled funds. Nearly half (49%) said they would not launch one in the next 12 months (see figure 9). However, a total of 20% said they would launch a UK-domiciled fund, whether that be a Ucits, an alternative investment fund (AIF) or both. Given that only 30% of our respondents were based in the UK, this does not seem a low percentage.

It is worth adding that a low number of planned UK fund launches does not necessarily imply a pessimistic view about Brexit; it may indicate that respondents have confidence in a post-Brexit cross-border distribution deal that would allow EU-domiciled funds still to be passported into the UK. By this logic, a high number of planned UK fund launches would indicate less faith in a cross-border deal.

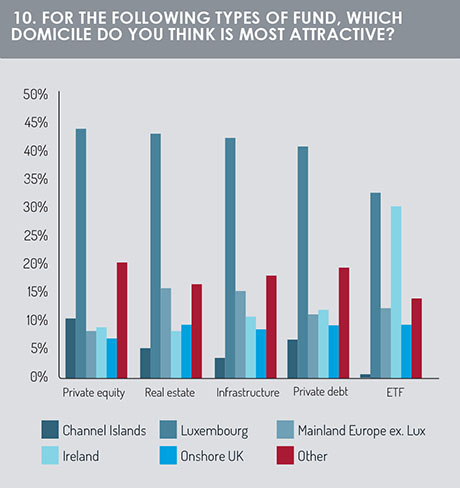

But what about other domiciles? We asked about domiciliation from the perspective of managers of alternative funds, which often require specific skills from their administrators, custodians and so on. For four types of alternative fund, as well as for ETFs, we asked respondents to say which domicile was most attractive. Luxembourg was comfortably the winner for all four (see figure 10). It was the most favoured option for ETFs too, though it only narrowly beat Ireland.

But what about other domiciles? We asked about domiciliation from the perspective of managers of alternative funds, which often require specific skills from their administrators, custodians and so on. For four types of alternative fund, as well as for ETFs, we asked respondents to say which domicile was most attractive. Luxembourg was comfortably the winner for all four (see figure 10). It was the most favoured option for ETFs too, though it only narrowly beat Ireland.

For the other domiciles, there was some variation according to fund type. The Channel Islands was much more likely to be favoured for private equity funds than infrastructure funds. Mainland Europe, excluding Luxembourg, was much more favoured for real estate and infrastructure than for private equity. For all fund types, the “other” category was popular, reflecting the abiding popularity of non-European domiciles such as the Cayman Islands.

These findings indicate the abiding importance of Luxembourg for alternative fund managers. Service providers with a presence there, especially when it comes to the depositary bank function, are likely to enjoy an advantage in this sector.

These findings indicate the abiding importance of Luxembourg for alternative fund managers. Service providers with a presence there, especially when it comes to the depositary bank function, are likely to enjoy an advantage in this sector.

Rather cryptic

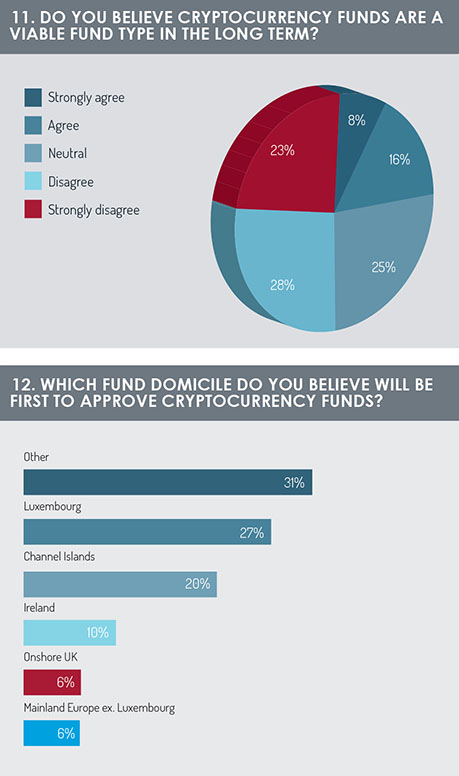

Cryptocurrencies have brought about one of the most divisive trends in financial markets. Whether the likes of Bitcoin, Ethereum and others are a new paradigm or a terrifying bubble is a question hotly debated. A number of our respondents maintain a sceptical position regarding the viability of mutual funds based on cryptocurrencies. Only 24% agreed or strongly agreed that cryptocurrency funds were a viable fund type in the long term (see figure 11). It would appear that many of our respondents are determined not to be carried away by the craze.

Nevertheless, cryptocurrency funds are becoming a reality. In a question that was devised before such funds hit the market (a handful of launches have occurred since), we asked which domicile would be the first to approve this kind of product. Rather than pick one of the major European domiciles on our list, the largest number of respondents, 31%, said “other” (see figure 12). Luxembourg came second (27%) and the Channel Islands third (20%).

Respondents who selected “other” were asked to specify which domicile they had in mind. The Cayman Islands was mentioned nine times, along with Bermuda and other “Caribbean offshore islands having weak regulations”. The US, Estonia and Malta were also mentioned. One respondent said Bitcoin fans ought to look to the East, writing that “I think crypto will be pioneered by Asia”.

Respondents who selected “other” were asked to specify which domicile they had in mind. The Cayman Islands was mentioned nine times, along with Bermuda and other “Caribbean offshore islands having weak regulations”. The US, Estonia and Malta were also mentioned. One respondent said Bitcoin fans ought to look to the East, writing that “I think crypto will be pioneered by Asia”.

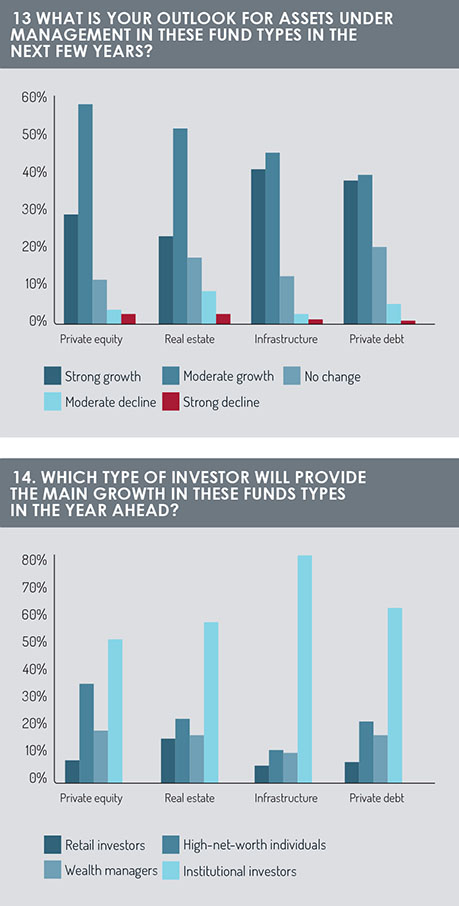

Earlier in the survey, we established that our respondents had identified a rise in interest in alternative funds. But which types of alternative fund will grow fastest? For private equity, real estate, infrastructure and private debt funds, we asked respondents to say whether they expected strong growth, moderate growth, no change, moderate decline or a strong decline in assets under management.

On balance, infrastructure funds were most hotly tipped. Forty percent of respondents said they expected strong growth and a further 44% said they expected moderate growth (see figure 13). Private debt also had its champions, with 36% predicting strong growth; however, 19% expected no change for private debt, a larger proportion than for the other fund types.

Clearly, alternative fund types are expected to grow, but the expected speed of this growth varies between asset classes.

In figure 14, we took the same set of fund types and asked which type of investor would provide the main growth in the coming years. Institutional investors came top for all four fund types, but by a variable margin. Institutional investors were expected to be particularly dominant in infrastructure funds, where three-quarters of respondents expected them to provide the main growth. In contrast, 46% of respondents expected institutions to provide the main growth in private equity assets. Thirty-one percent of respondents expected high-net-worth investors to provide the main growth in private equity assets, whereas the equivalent proportion for infrastructure funds was 10%.

In figure 14, we took the same set of fund types and asked which type of investor would provide the main growth in the coming years. Institutional investors came top for all four fund types, but by a variable margin. Institutional investors were expected to be particularly dominant in infrastructure funds, where three-quarters of respondents expected them to provide the main growth. In contrast, 46% of respondents expected institutions to provide the main growth in private equity assets. Thirty-one percent of respondents expected high-net-worth investors to provide the main growth in private equity assets, whereas the equivalent proportion for infrastructure funds was 10%.

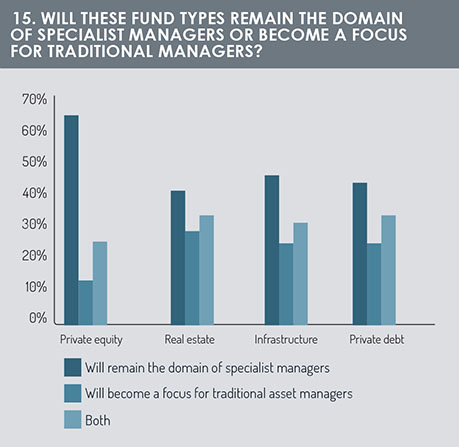

The final question (see figure 15) took the same set of alternative fund types and asked, would these remain the domain of specialist managers or become a focus for traditional managers? Private equity was deemed to be the most impervious to traditional managers. Sixty-two percent of respondents thought private equity funds would remain the domain of specialists, while just 13% expected traditional managers to make it a focus (25% said they expected to see both trends). In contrast, only 40% of respondents expected real estate funds to remain the domain of specialists, compared with 28% who thought traditional managers would make it a focus.

The confidence in the significance of specialist managers is likely to be mirrored by a confidence in the role of specialist service providers, since these players are most familiar at meeting the needs of specialist investors.

Conclusion

Conclusion

This report has aimed to determine the opinions of a cross-section of the funds industry about some of the most pressing trends facing funds professionals. Although there is near-unanimity on some questions – the need for asset managers to “redefine their offering”, for instance – there was less of a consensus on other issues, such as whether asset managers need to be big to survive, or whether cryptocurrency funds are a viable fund type in the long term.

The funds industry faces many uncertainties. Perhaps now, more than ever, it is important to find strong, stable and innovative partners to help navigate the difficult path ahead.

For the final part of the report, click here.

©2018 funds europe