If it sometimes seems as if there’s an ETF covering every conceivable market, industry or commodity, it’s because there probably is. While it’s possible to invest in weird and wonderful ways, Kit Klarenberg finds this may not be an entirely positive development.

For much of the two decades following the launch of the first publicly investable ETF (the American Stock Exchange S&P 500 Depository Receipt) in January 1993, ETFs were similar to their index fund forebears. Each vehicle offered access to a broad, market cap-weighted index of stocks listed in a particular country, region or exchange.

However, recent years have seen an eruption of ETFs investing in new asset classes, and specific sectors and markets. Bonds, commodities, currencies, derivatives, real estate and style ETFs have all become commonplace. ETFs catering to alternative investment strategies, such as leveraging and shorting, have also gained in prominence.

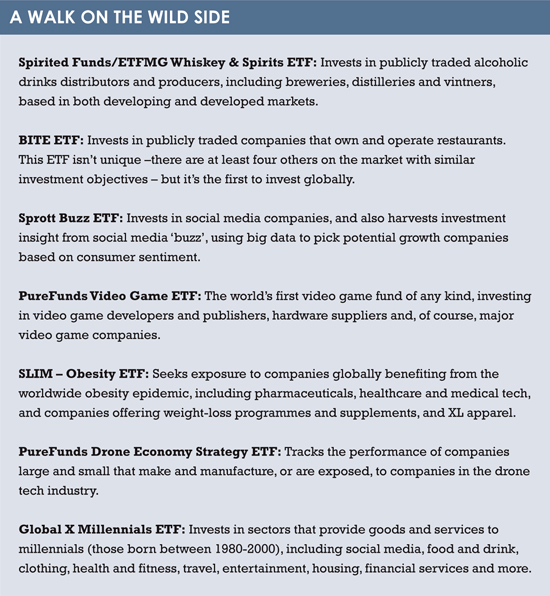

This year has seen ETFs grow more targeted and particularised than ever before, offering investors access to narrow sub-sectors, niche industries and investment themes that would’ve been unthinkable 20 years ago. These rarefied vehicles are multiplying all the time – Aaron Levitt, analyst at ETF Database, says 2016 has seen dozens of eyebrow-raising launches. His selection of the year’s most peculiar vehicles can be found above.

Some may find this trend troubling, a corruption of the original intent of ETFs – to provide broad, global exposure to markets at a low cost. Even advocates of specialist products advise investors to advance with some caution – Howie Li, co-head of ETF Securities’ DIY ETF platform Canvas, fears that it may be all too easy for get lost in the plethora of products, jargon and marketing messages abuzz in the market.

As a result, he says investors should ask themselves two key questions before investing in a niche ETF. First, what is your investment objective? Before focusing on a sector, theme or asset class, investors need to be clear about the types of returns they’re seeking.

“This naturally feeds into their appetite for risk and investment horizon, and is especially true if an investor is looking at thematic investing, where exposure is intended to have uncorrelated returns vis-à-vis mainstream asset classes the investor may already be sitting on,” he says.

“Second, do you fully understand and accept the investment case? We offer thematic equity ETFs – such as automation, cybersecurity and robotics – because it’s our view the world we live in is being transformed. Tech is shaking up the status quo, and companies in these sectors are likely to outperform major equity benchmarks over time. Investors need to accept this hypothesis, over and beyond being simply attracted by the raciness of the theme.”

“Second, do you fully understand and accept the investment case? We offer thematic equity ETFs – such as automation, cybersecurity and robotics – because it’s our view the world we live in is being transformed. Tech is shaking up the status quo, and companies in these sectors are likely to outperform major equity benchmarks over time. Investors need to accept this hypothesis, over and beyond being simply attracted by the raciness of the theme.”

Levitt plays down worries about specialist funds. He says that classic vehicles of the extremely broad geographical kind – most of which were launched before 2001 – account for around a third of ETF assets presently. The bulk of the rest of ETF assets are held in new asset class ETFs, such as bonds, commodities and property.

“Investors have a clear tendency to gravitate towards established products, which have better-established track records and larger assets under management,” he says.

Nonetheless, he acknowledges extremely niche ETFs do pose potential problems. For one, their diversification benefits are at best limited, at worst non-existent. As a result, the vast majority of these vehicles are suitable only for investors who wish to overweight a highly specific section of the market, and should only be peripheral holdings in a diversified portfolio – never core components in themselves.

“Also,” says Levitt, “niche ETFs have nowhere near the level of liquidity of broad index ETFs. This is because by definition they track the performance of less heavily traded stocks, producing wider ‘bid-ask’ spreads, and higher trading costs.”

NEOPHILIA

Despite these issues, EY’s latest Global ETF Survey, published in the first week of November this year, suggests the trend towards specialist ETFs has little chance of abating – at least for the time being.

Polling the opinions of 70 leading providers, which account for 86% of ETF assets worldwide, it found 76% viewed innovation as a key source of differentiation from their competitors, and 17% felt pressured to be first to market with innovative offerings.

The report also found new entrants to the market depended almost entirely on eye-catching products to stand out in the market, while the biggest providers relied on innovative launches to open fresh conversations with investors.

This avowed reliance jars somewhat with concurrent anxiety that increasing complexity and specialisation of ETFs makes it harder for firms to test and seed products before launch, although 64% of respondents acknowledged that the failure rate of ETFs was likely to worsen considerably.

This should be a cause for concern – for providers, at least. ETFGI figures indicate failure rates are already fairly high; of the more than 6,000 ETFs on the market, around 2,000 hold assets under €10 million. These funds arguably should be primed for the chop, but ETF providers seem reticent to jettison lacklustre performers – a mere 111 closed between January and October this year, compared to 260 launches. The only thing that could stem the tide may well be regulatory meddling.

©2016 funds europe