European equities started the year with a fanfare, but earnings, political risk and currency strength are still a worry for some fund managers, finds Fiona Rintoul.

A quick glance at equity market commentaries from the first months of this year can leave a person feeling a little unsettled. It’s almost as though everything that has been held to be true for the past several years is now held to be false.

Where once emerging markets were the site of all returns – and the only place with economic growth, positive demographic trends and conscionable levels of indebtedness – it’s now Europe that’s being feted.

This shift in sentiment is perhaps partly down to human nature. The shine has gone out of emerging markets so investors are looking elsewhere for all that glitters.

“Markets do tend to get quite romantic about one area and then get romantic about another area when that doesn’t work,” says James Butterfill, global equity strategist at Coutts.

However, the weird monetary policies pursued by developed nations during the credit crisis have also had an effect. “One of the side effects of quantitative easing is exactly that,” says Luca Paolini, chief strategist at Pictet Asset Management. “The market is very volatile.”

Sentiment on Europe started to pick up in 2013, and fund flows reflect this. According to data from Lipper covering funds domiciled in Europe, net sales of emerging markets funds broadly fell month-on-month in 2013, hitting a low point of -€3.1 billion in June, while net sales of Europe funds rose, peaking at €5.2 billion in October. Over the year, net sales of Europe funds were €28 billion – twice the level for emerging markets funds.

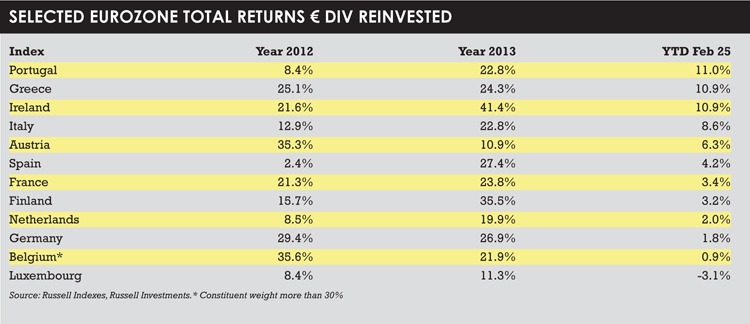

The numbers for stock market growth (see table) make it seem obvious that it should have been so, but somehow it wasn’t obvious. It wasn’t really until late 2013 and early 2014 that the pro-Europe rhetoric reached its peak.

“We went long Europe in March 2013, but it was very anti-consensus then,” says Butterfill.

He also notes that the return to European equities has only been partial. Across European stock markets, inflows in 2014 were $75 billion (€55 billion), while during the credit crisis outflows reached $180 billion. “A lot of people haven’t participated yet,” he says.

Neither have analysts revised their views on Europe in a wholesale way. Revision ratios from Ibes (Institutional Brokers Estimate System) show that 32% of analysts have upgraded their view on Europe compared to 42% on the US.

The number of European shares being traded has also stayed fairly low. “Volumes are still only around one-third of pre-crisis levels,” says Butterfill.

This may be because it is early days. Diego Franzin, head of equity – Europe at Pioneer Investments, says the turning point for European equities came in the second quarter of 2013.

“Before the second quarter of 2013, we only had positive inflows in a very selective way. Then something switched and people were willing to consider European equities again. Now, interest is coming back from a widespread set of investors.”

The question now is whether this renewed confidence is justified, and here opinion is split.

EUROPE’S EM EXPOSURE

Franzin believes the market is at a turning point where what has been working so far won’t work any more. “It’s really a change of leadership,” he says.

What this means in practical terms is a repricing of emerging markets exposure in European stocks. “If you look at the performance of companies exposed to emerging markets and companies exposed to developed markets, those exposed to emerging markets have underperformed – and by a considerable margin: 5% to 10%.”

You could see this as a new normal or even an old normal. You could see it as part of the same realignment that saw one-time basket cases Portugal and Greece top the Russell Eurozone index year-to-date, and that might yet bring European financials back in the from the cold.

You could concur with Franzin when he says “what has been perceived as quality over the last ten years might not be perceived as quality over the next two to three years”. And that includes the aforementioned peripherals and financials.

“If you project two to three years out it could be that quality comes back to banks,” he says. “Sooner or later they will go back to being investable. You see the same thing in the peripherals. You can find decent quality there.”

However, optimism about continued good performance from European equities is not exactly overwhelming. Much will depend on the next earnings seasons, the last one having been “very mixed”, in the words of Butterfill. He broadly believes that analysts’ lack of confidence in Europe is misplaced, but sees 2014 as a make-or-break year for it.

“The trade last year was the ‘Europe not breaking up’ trade, and the trade this year is the ‘earnings growth trade’,” he says. “We’ve got to see earnings coming through or valuations look vulnerable.”

Paolini also believes that earnings are crucial. “If you look at valuations, Europe is trading the global average for the first time. The surprise factor is over. We need to see something else.”

In his view, a pick-up in earnings won’t come until the euro weakens.

“We think the euro will weaken because the [Federal Reserve] is effectively tightening.”

YEAR OF VALIDATION

Russell Investments also considers that the risk-on posture in the market indicated by the strong relative year-to-date returns for the Russell Eurozone Dynamic Index and for Greece, Portugal and Italy cannot continue without support.

“2014 continues as a year of validation in the eurozone, as the markets seek proof in the European economy that the strong equity market gains of 2013 can be sustained,” says Wouter Sturkenboom, investment strategist with Russell Investments Europe.

Another concern for some is that people are now underestimating the political risks in Europe – having possibly overestimated them previously. Just because it is not as bad as it was doesn’t mean everything is well.

“There’s a lot of complacency that everything is going well,” says Paolini. “Growth has accelerated but it is not strong, and the European elections in May could still be a big surprise, for example if there is a strong showing from populist parties.”

In fact, Pictet is ploughing a lonely furrow and completely resisting the temptation to give a fanfare for Europe.

“We are probably the only one, but we have a strong preference for emerging markets over Europe,” says Paolini.

“We believe the gap in sentiment between Europe and emerging markets is not justified.”

That is not to say that Pictet is avoiding Europe altogether. “Europe is definitely not the first region we will look at, but we are not going underweight the only region where we see positive economic momentum.”

It’s all about being tactical because sentiment can change so quickly in an environment where the investment horizon is shorter than normal. Since Pictet expects the euro to weaken, unlike some other fund managers, it has a preference for export-led companies in Europe.

“We think the story about domestic consumption may already be priced in,” says Paolini. “We prefer to go for stocks that were hammered by emerging markets.”

Selectivity, in fact, is the name of the game across the board.

MACRO NO LONGER WORKS

A more normal environment in Europe means chasing macro stories no longer works. It’s back to proper fundamental analysis, says Franzin. “It’s much more resource-intensive, much more difficult to generate real alpha.”

For a natural bottom-up stock picker, this can come as something of a relief, after the political second-guessing and country juggling that was almost essential during the credit crisis. “We are overweight France,” he says, “but not because we are positive on France or have a particular outlook on France.”

Investors have also become more selective, with a clear split in their minds as to where they can buy cheap beta and where they need to pay for alpha – a focus that is not new but has perhaps been sharpened by the exigencies of the credit crisis.

“Investors are interested in new products and new value propositions. They are keen to understand how outperformance has been generated.”

And although the rhetoric in the market may make it feel like emerging markets are out and Europe is in, actually no one is firmly backing one horse over the other. Butterfill points out that poorer recent performance from emerging markets doesn’t necessarily mean the fundamentals have changed.

“Emerging markets are still very attractive. It’s just that they’re getting hammered by the US dollar and tapering.”

There has been a repricing of the other side of the market, but the emerging markets story is not about to go away. Like everything else, it will just be more tactical.

“We look at emerging markets selectively,” says Paolini. “We buy markets where we can see the story or where the valuation case is strong.”

©2014 funds europe