As the Latin American asset management market develops, servicing firms are lining up to offer their expertise. Nicholas Pratt looks at the latest movements.

The asset servicing industry’s approach to international business development broadly consists of going wherever the investors go. So as asset allocation continues to switch from developed to emerging markets, it is no surprise new international asset servicing businesses are expanding their operations in Latin America.

So far, the asset servicing firms have primarily focused on Brazil, the largest of the Latin American markets. It is the eighth largest economy in the world according the International Monetary Fund figures. More importantly, it is the sixth largest investment market with more than $900 billion (€683 billion) in assets, according to the Investment Companies Institute based in the United States. Furthermore, Brazil’s investment industry is growing at a far faster rate than any of its developed world counterparts, having expanded by 82% between 2007 and 2011, compared with 13% in the US, 7% in Luxembourg and 4% in the UK.

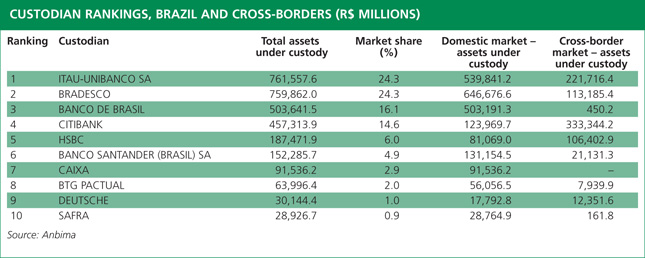

Brazil’s custody market has traditionally been dominated by its three largest domestic banks – Itaú Unibanco, Bradesco, and Banco do Brasil, particularly when it comes to domestic custody services where the three share close to 75% of the market. Many of the asset management firms are bank-affiliated, such as Bradesco Asset Management, and asset servicing arrangements are consequently kept in-house.

A cross-border custody market is developing though, offering greater opportunity for the international providers in terms of local and independent asset managers wanting to invest internationally and also for international asset managers and investors wanting a recognised brand name to help them navigate their way through a new and unfamiliar marketplace.

Citi is now the largest custodian in the cross-border market with 38% market share, a figure that has more than doubled since May 2011 and seen it rise to fourth in the rankings. HSBC is the next biggest international custodian with a 12% share and it has also seen its cross-border business grow by almost 50% since May 2011.

Spain-based Banco Santander is the sixth largest custodian in Brazil, although, thanks to its Hispanic heritage and recognised brand name, its domestic custody business is more than six times the size of its cross-border business. For Citi and HSBC, the focus is very much on the cross-border market and offering sub-custody services to global custodians looking to expand their own networks.

Cross-border business

This is not to say that the cross-border market is not of interest to the Brazil-based banks. The majority of cross-border business is still owned by Itaú Unibanco and Bradesco which account for almost 80% of market share between them. Behind these two though are Citi and HSBC.

Meanwhile, many of those international asset servicing firms relying on Citi and HSBC’s sub-custody networks are looking to expand their operations in Brazil and its surrounding markets are all too aware that a physical presence will be key to future success in the region. JP Morgan, for example, recently announced that it has insourced its global custody business in Brazil and will be offering its own direct custody and clearing service.

Despite the interest of international and domestic providers, a fruitful cross-border market across Latin America is not guaranteed. In Brazil and Argentina, foreign investment flows could be subject to unfavourable economic policies, says Colin Brooks, global head of sub-custody and clearing at HSBC.

In Brazil, there is concern that there will be a tax imposed on investment inflows in order to protect the Brazilian real. However, says Brooks, the fact that Brazil remains a huge and growing economy should outweigh this concern.

In Argentina, the second largest economy in South America, constraints on foreign investment are a result of efforts to protect the local currency and, without the growth of Brazil or the imminent prospect of a Fifa World Cup and Olympic Games, it is unlikely to be an attractive destination for foreign investment in the short term. Nevertheless, it still remains one of the largest markets in South America and, therefore, an important-long term prospect for international asset servicing firms.

In the short-term, there is a growing interest in the markets of Colombia, Chile and Peru which are all making a noticeable effort to attract foreign investment, as seen by the recent opening of the Mila (Mercado Integrado Latinoamericano) exchange, which combines the three countries’ previous national exchanges. For custodians, the hope is that the exchange will spark more activity in the underlying investment market, especially from outside investors.

Local interest

BNY Mellon has been operating in the Latin American asset servicing market for more than ten years and its overall strategy is relatively simple: focus on those areas where global custodians stand the best chance of competing against the domestic incumbents.

“There is an interesting opportunity to grow in markets where there’s a greater comfort with foreign investment, both from the regulators and also the mutual funds themselves,” says Mike Kalavritinos, business head for Latin America and Caribbean asset servicing at

BNY Mellon. He names Mexico, Chile, Peru and the Caribbean as places of focus. Brazil, where the firm has the largest regional presence with 400 staff, remains the area of most interest.

The human resources issue is likely to become progressively important. For sub-custodians, a local presence is key. But as the business becomes increasingly international, might it be difficult to combine local and global expertise?

Brooks at HSBC says: “The vast majority of our staff are local and have a lot of experience in the international market. They are aware of what international investors and custodians are looking for. A strong domestic presence is vital for sub-custody because it is about maintaining sound relationships with local regulators to represent your clients.”

The universal experience among the locals is derived from the time that many spent outside the market and also the fact that in places like Brazil and Argentina, the cross-border market has been growing for several years. “Our senior people who have stayed in these markets have a long experience of dealing with international clients,” says Brooks.

It is a similar story for other international asset servicing firms. “We staff locally and we source from the local market where possible,” says Kalavritinos. But many firms are finding that recruiting staff at a senior level is becoming increasingly challenging and this is likely to continue in the short-term as the various asset servicing firms manoeuvre themselves into a position of strength.

“It is difficult to find people locally with cross-border experience. In the short-term, we will be looking for a knowledge transfer from people outside the market, from the US and Spain. But as the industry matures and career development, education and training become more entrenched, the pool of [local] talent in senior management positions will hopefully increase.”

As the cross-border investment market grows across Latin America, it is possible that experienced senior staff will be at a premium, especially as competition between an increasing number of asset servicing and custody providers intensifies. This could possibly trigger a lot of staff movement between firms.

For example, BNP Paribas Securities Services Brazil launched in June 2010 with Marcia Rothschild appointed as its head. She relocated to her native country after eight years working for BNP Paribas in New York. In August, she was appointed by Citi as its head of Latin America securities and fund services client and sales management.

Regional competition

Meanwhile, in the same month, BNY Mellon appointed Diego Folino as its country executive in Mexico to “oversee the strategic direction and expansion of the company’s local capabilities and presence across all business lines in Mexico”. He was previously employed at Standard Chartered.

According to Brooks, this movement of senior staff is happening across all firms and between the domestic firms as well as the international firms, suggesting that as competition in the region intensifies, there is the possibility of a battle for senior executives.

Consequently, we are likely to see asset servicing providers go to great lengths to sell themselves not only to the asset managers and investors but also to potential employees as the provider of choice.

The advantage for the likes of HSBC, says Brooks, is that it can offer geographical scale as a means of career development. While he says that there has not yet been a frenzy of senior management recruitment, it is something that happens in emerging markets as they expand. “People are keen to recruit those with experience so there is always going to be a turnover of staff,” he says.

“At HSBC, we have to make sure we are competitive on both remuneration and career development by offering them the opportunity to broaden their horizons in a number of international markets.”

©2011 funds global