We examine the most interesting fund launches in the recent past and profile one fund a year after it began.

BETTING ON JAPANESE DIVIDENDS

Last year’s rally in the Japanese equity market was driven almost entirely by foreigners, says Scott McGlashan, senior fund manager at JO Hambro Capital Management, who believes domestic investors will now begin to play a bigger role and help to drive a multi-year bull market.

One consequence of greater domestic involvement could be bigger dividends. “A dividend culture is emerging in the Japanese equity market,” says Ruth Nash, also a senior fund manager at JO Hambro. “While pay-out ratios in Japan still lag the global average, this is likely to change as companies attempt to cultivate long-term shareholders by increasing dividends.”

One consequence of greater domestic involvement could be bigger dividends. “A dividend culture is emerging in the Japanese equity market,” says Ruth Nash, also a senior fund manager at JO Hambro. “While pay-out ratios in Japan still lag the global average, this is likely to change as companies attempt to cultivate long-term shareholders by increasing dividends.”

McGlashan and Nash are co-managers of the Japan Dividend Growth fund, which invests mainly in large-cap stocks and will incorporate a blend of dividend growth and dividend yield.

PROPERTY WITHOUT BRICKS AND MORTAR

PROPERTY WITHOUT BRICKS AND MORTAR

For many investors, real estate is an appealing asset class because it is a “real” asset, offering all the assurance that bricks and mortar provide. But according to North Row Capital, part of Brooks Macdonald Funds, not every investor in real estate wants to own physical property.

The firm’s IFSL North Row Liquid Property Fund, which is now open to UK retail investors, aims to recreate commercial property returns by investing in property derivatives and equity and debt linked to property markets. The advantages include a lower minimum investment (£10,000) than most property funds and no liquidity restrictions associated with buying and selling real property assets.

Steven Grahame, fund manager, says he expects total returns from property in the UK to exceed 12% this year, greater than an industry consensus he puts at 9.3%.

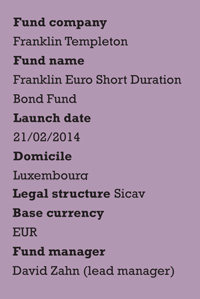

MAKE IT SHORT-DATED

MAKE IT SHORT-DATED

Bond investors are scrambling to reduce the duration of their bond portfolios as a much-feared rise in interest rates looms on the horizon. Franklin Templeton recognised the trend yet found it had a gap in its product range for a fund investing in short-duration bonds in the eurozone.

The Franklin Euro Short Duration Bond Fund will invest in short-dated fixed and floating-rate bonds from corporates and sovereigns of investment-grade or comparable quality. It has some flexibility to invest outside the eurozone or in derivatives.

David Zahn, head of European fixed income, says short-dated eurozone bonds “provide portfolio insulation and opportunity for enhanced return in a rising rate environment”.

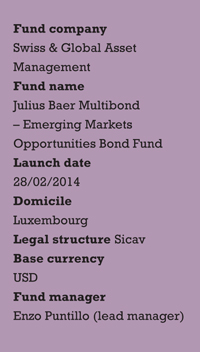

STILL HOPE FOR EM BONDS?

STILL HOPE FOR EM BONDS?

The fashionable thing to say about emerging markets is that they’re not all moribund, one just has to be selective about which to choose. Swiss & Global Asset Management appears to hold this view; it says its new emerging market bond fund will be untied to a specific universe or benchmark to give its managers the flexibility to gain returns in this difficult asset class.

The fund can invest in both government and corporate bonds in hard and local currency, with or without inflation hedging. At launch it had large local currency positions in Brazil, Mexico and Poland, and hard currency positions in Indonesian and eastern European government bonds.

“We focus on countries where changing fundamentals are not yet fully reflected in bond valuations,” says Enzo Puntillo, head of fixed income emerging markets.

SHARIA FOR ASIAN EQUITIES

SHARIA FOR ASIAN EQUITIES

In March 2013, Franklin Templeton’s executive director and emerging market evangelist, Mark Mobius, announced the launch of a shariacompliant version of his existing Templeton Asia Growth Fund.

The product was designed for Islamic investors who wanted access to the growth markets of Asia without compromising their religious principles. The equities in the fund’s universe would be screened by Islamic finance consultancy Amanie Advisors to ensure that any un-Islamic stocks were excluded.

One year on, it seems the fund has suffered alongside its peer group from the selling of emerging market assets that followed the US Federal Reserve tapering announcement. However, it is interesting to the note that the sharia-compliant fund’s performance of -12.9% in the year ending February 28 is slightly better than the performance of the original, noncompliant fund, which is down -13.2%.

The fund’s benchmark, the MSCI AC Asia ex- Japan Islamic Index, declined by a more modest -4.4% in the same period.

A spokesman for Franklin Templeton says that “while there are performance challenges on the short term, these are medium to long-term funds that provide higher returns over a longer duration”.

©2014 funds europe