Funds and mandates that incorporate environmental, social and governance criteria are flourishing. The jury is out on how they perform compared to mainstream funds, but do they make money for the companies that run them? Fiona Rintoul reports.

In terms of assets under management (AUM), ESG funds have been on a broadly upwards trajectory for several years, albeit with some bumps along the road during the financial crisis. Data from Morningstar shows AUM in socially conscious funds totalled €183.8 billion in 2016, up from €87 billion in 2011. True, the market share of these funds didn’t move much in that period – from 5.6% to 5.9% – but the past 18 months have seen an unprecedented surge in demand for ESG products.

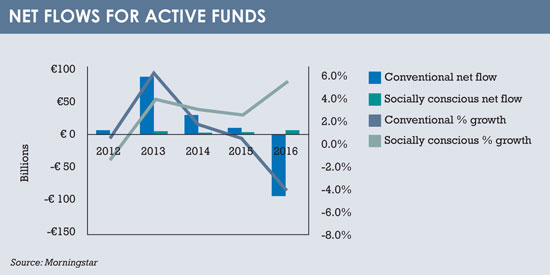

Morningstar data (see chart, page 14) shows increased net flows to socially conscious equity funds in Europe of €13 billion in 2016 – up from €9 billion in 2015 – at a time when flows to mainstream funds were under pressure. Flows to passive mainstream equity funds fell from €53 billion in 2015 to €20 billion in 2016, while active mainstream equity funds had whopping outflows of €91.5 billion in 2016 compared with modest inflows of €9 billion in 2015.

“We’re moving beyond niche and becoming a more mainstream, core global equity product,” says Nick Anderson, co-manager of Henderson Global Investors’ Global Care Growth fund, which invests in companies whose products and practices enhance the environment and life of the community. “In the last 12 months, we’ve had the opportunity to interact with ethical independent financial advisers (IFAs) but also mainstream IFAs.”

Institutional investors too are increasingly looking for ESG portfolios. For some, such as pension funds, investing in these portfolios is a requirement. Camradata, which provides assisted searches for institutional investors, this year saw a 133% rise in socially responsible investment searches compared to last year. “The type of investors that are looking for ESG funds are Scandinavian, German and UK consultants and local authority pension schemes, with mandates up to £100 million (€117 million),” says Amy Richardson, associate director, client relations – pensions at Camradata.

As well as demonstrating increased interest, the available evidence suggests that ESG investors want funds that pursue their ESG objectives with vigour. A recent report on green environment-themed funds in Europe from Novethic, a French research centre on responsible investment that is part of the Caisse des Dépôts Group, shows higher growth in assets over the past three years among so-called ‘dark green’ funds, that are true to their objectives (64%), than among ‘light green’ funds that aren’t (26%). So, more investors want ESG funds and they want their funds to be more ESG. But, whatever approach ESG funds take – and the possible approaches are many – there is a cost involved, especially as some headline ESG data can mislead.

“Companies that make more data available are better rated, but that doesn’t mean they are better,” says Laetitia Hamon, a manager at KPMG in Luxembourg.

GENERATING PROFITS

If you are agnostic on the superiority of ESG funds’ performance, you may ask how the cost of getting the right data and looking behind the data affects the bottom-line contribution of ESG funds to their promoters’ profits. At the most basic level, it’s safe to assume that, as fund management companies aren’t charities, ESG funds do generate profits.

Many large fund management companies that run traditional investment funds have a range of ESG funds. The top 10 managers of green funds cited in the Novethic report include such well-known mainstream names as Pictet Asset Management, BNP Paribas Investment Partners, Pioneer Investments, BlackRock, Jupiter Asset Management and Deutsche Asset Management, alongside specialist firms such as Triodos and ÖkoWorld.

“If they do this, you can be sure there is a financial return in it,” says Hamon.

At the same time, ESG research takes time – and time is money.

“By targeting these areas, you do increase certain aspects of cost,” says Bruce Jenkyn-Jones, co-head of listed equities at Impax Asset Management, a specialist investor in environmental markets and resource efficiency. “We’re looking at companies that enhance resource efficiency. Identifying those companies is an extra step in the process and needs an extra level of expertise.”

In addition, as part of its general analysis, Impax AM aims to understand how companies handle the ESG risk in their businesses. This means the coverage per analyst may be lower than in a traditional fund manager.

There are ways of reducing the cost burden that this creates. One is to use an external provider for some research. For example, Henderson works with Vigeo Eiris, an ESG research provider, for its investment exclusions.

“We took the decision five years ago to partner with them and tap into their economies of scale,” says Anderson. “It’s a specialist task, and we believe they can do that in a more commercial way.”

In any case, the additional cost of the more intensive research associated with ESG funds is sometimes self-refunding.

“There is an extra level to what we’re doing that we think enhances performance,” says Jenkyn-Jones. “By targeting companies that seek to solve environmental problems, you find yourself in high-growth markets and incorporating ESG risk into company assessments gives you better quality.”

DEMANDING

A similar give-take dynamic exists for client information. Transparency is particularly important in socially responsible investment, and investors tend to be more demanding in terms of the information they want to see than mainstream investors.

“There’s more interrogation from the client,” says Anderson. “People are making important choices about where they want their capital deployed.”

Henderson aims to manage this burden by providing a lot of voluntary disclosure. There is, for example, an annual engagement report for the Global Care Growth fund, and Henderson has a ‘Knowledge Shared’ section on its website where it provides information on future trends.

The company also receives a payback on its investment in research and information through investors who are attracted to a product such as the Global Care Growth fund. “Clients in this area are looking for long-term investment performance,” says Anderson. “They’re not seeking to churn and burn. They want to have faith in what you’re doing and they tend to stick with you.”

Sticky clients like these cost less than investment butterflies. Having ESG funds can bring other benefits too. It may be hard to give them a monetary value, but that doesn’t mean they don’t have one.

“If a big asset manager that runs traditional investment funds sets up a range of ESG funds, it will attract different types of investor,” says Hamon. “It can be a reputation issue as well.”

And, since scalability applies to ESG funds and research in the same way that it does to all areas of the investment business, the cost burden of running ESG funds reduces as assets under management rise. Having passed £5 billion of AUM, Impax now has margins just below 20% and rising – but when revenues dipped a few years, profits were hit too.

And, since scalability applies to ESG funds and research in the same way that it does to all areas of the investment business, the cost burden of running ESG funds reduces as assets under management rise. Having passed £5 billion of AUM, Impax now has margins just below 20% and rising – but when revenues dipped a few years, profits were hit too.

“We feel we are making similar profits to other areas of the business,” says Jenkyn-Jones. “And we have the same issues as everyone else with scalability.”

As ESG funds become more mainstream, they make more financial sense for their promoters as well as their investors – in the same way the kinds of companies they invest in increasingly make hard financial sense. That’s one reason why few ESG investors are worried about the anti-environmental protection rhetoric emanating from the US president.

“It’s gone beyond politics,” says Anderson. “Technology is bringing down the cost of electric vehicles, while the cost of extracting fossil fuels is going up. One of the biggest growth markets for wind farms in the US is Texas.”

Due in part to such developments, demand for ESG research has spread beyond ESG funds. For a company such as Henderson GI, which manages mainstream and ESG funds, that helps to spread the cost burden.

“We run an ESG rule over all our funds,” says Simon Hillenbrand, head of UK retail at Henderson GI. “It’s very much embedded.”

IMPACT INDICATORS

Assessing the net contribution of ESG funds to their promoters’ businesses – or to society – may not just be about measuring their contribution to profitability. It may require a new way of looking at the world in tune with businesses’ increasing awareness of their social and environmental impact.

KPMG has released a report on a new methodology – KPMG True Value – which helps businesses combine financial earnings data with “monetised externality data”. If such a methodology could be extended to funds, Hamon believes it would be very interesting for institutional investors. “There are lots of impact indicators, but it’s a challenge to monetise that,” she says.

©2017 funds europe