The retail distribution landscape is changing, and asset managers need to know the drivers of this change as well as the most appropriate strategies to come out ahead in this disrupted environment, says CACEIS.

Retail fund distribution is in the midst of the most profound structural change of the past 50 years. The prospects for funds in this incredibly dynamic business environment are positive. Opportunities are numerous and assets are growing with sustained growth projected for the industry (e.g. pensions, non-bank financing).

Yet, the balance of power between the legacy industry players, such as asset managers, institutional investors and distributors, is uneven, and the entry of new players, like East-Asia asset managers and tech firms, is altering the status quo.

This business disruption is exacerbated by three main factors: Regulations, Millennials and Technology.

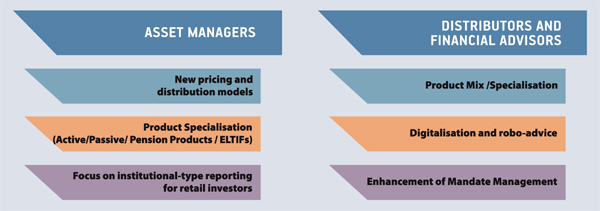

Consequently, new strategic responses and value propositions are needed both for asset managers and distributors.

RETAIL CLIENTS TAKE CENTRE STAGE

As retail clients take centre stage in the new regulatory agenda, which puts “clients first”, fee transparency and a focus on arm’s-length advice models will put retail and affluent clients in a much stronger position to obtain cheaper products (e.g. passive funds, inducement-free share classes) and tailored solutions (e.g. mandates, execution-only).

However, advice gaps could occur in client segments not ready to pay the full cost of advice.

PRODUCT PROPOSITIONS AND DISTRIBUTION MODELS

Asset managers are facing a dilemma: the traditional distribution model based on the retrocession of trailer fees is not sustainable in the medium term and, as a consequence, the array of products distributed across the EU is rebalancing. Actively managed funds (products extensively using trailer fees) and passive products (i.e. Index funds and ETFs) are now placed at the same level to compete for the same distributors and client segments.

Accordingly, active managers will need to adopt new pricing models, tailor cost-effective passive products or link the fees applied to active products to their performance.

In addition, they will need to strengthen their service offerings with solutions such as asset allocation funds, Smart Beta and non-fund mandates management in order to better serve distributors and financial advisers.

Finally, enhanced product solutions and reduced pricing will not always be sufficient to maintain or gain market share. Access to investors without an “incentivised” distribution network will become more challenging.

Various strategies are already emerging in the market as players move to secure greater access to investors:

- Share class re-engineering (i.e. asset managers are “cleaning” share classes from “trailer commissions” paid to distributors who introduce business to them);

- Direct platforms allowing retail clients to acquire a large number of funds available in the market;

- Advisory service enhancement such as Strategic shareholdings in robo-adviser platforms;

- End-client marketing to build up strong digital brand recognition in the retail space.

ENGAGEMENT MODELS

On the other side, the distributors need to provide retail clients with enhanced advice solutions, incorporating discretionary management and advisory services with a comprehensive products catalogue. In the trailer fees-free world, products will become “cost factors” for the distributors and, as such, management of the product shelf will be a core competency from a revenue and cost perspective.

However, a pure cost strategy will not be sufficient to distinguish distributors in the eyes of retail clients. In addition, they will need to develop better asset allocation capabilities and specialise in determined products or services, such as long-term saving solutions, to justify their advice fees.

NEW TECHNOLOGIES

The way new generations of investors interact with the industry and the way social media influences investment behaviour will be crucial elements of the change in the industry’s balance of power. Millennials are supplanting Baby Boomers as the primary investorship. In this new environment, technology is a catalyst for the creation of new disruptive business models (e.g. robo- adviser platforms).

The increasing adoption of SMAC (Social, Mobile, Analytics, Cloud) technologies to serve informed retail clients and create a constant flow of dialogue to promote products and services will be crucial. To increase brand recognition, ongoing multichannel dialogues with clients are likely to become a major differentiating factor in the industry. Also, to deliver proactive responses in a dynamic environment and to appease demanding clients, distributors will have to build robust data architecture in the “cloud”, enhance their IT security standards.

Retail clients of the new generation will become “instividuals” in terms of their sophisticated information consumption, which demands tailored service delivered through the latest technologies.

Investments in technology are fundamental for asset managers and distributors who hope to succeed in the new investorship environment where cost pressure is mounting and the level of services sophistication is increasing.

LOOKING FORWARD

The next stage of disruption is already underway—Millennials are increasingly making investment decisions on their own without advice or intermediation. In the era of SMAC technologies, the emergence of investor communities and mirrored investing is likely to challenge the primary role of asset managers and distributors in the asset management space.

As a matter of fact, these technologies have given people the opportunity to share information and opinions in peer-to-peer networks and to replicate the portfolios of peers who they think could beat the market. Companies like eToro and Ditto Trade have built their approach to investing on the basis of investor communities.

These changes have introduced a new arena to the asset management industry in which the roles of the distributor and the portfolio manager commingle with the financial skills of a community of investors in web-based social networks.

Disclaimer: CACEIS is a leading European asset servicing company with in-depth experience in helping clients make the most of cross-border fund distribution opportunities. For more information on the future distribution landscape or CACEIS’s cross-border fund distribution support services, visit us on www.caceis.com.

©2016 funds europe