We profile some of the most interesting fund launches in recent weeks and examine the performance of a product already on the market.

REAL ESTATE

REAL ESTATE

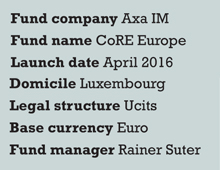

The real assets division of Axa Investment Managers is to launch a pan-European open-ended real estate fund, which will invest in a portfolio of core real estate assets across Europe.

Investments will focus primarily on mainstream asset classes, primarily well-located offices and retail hubs, let to tenants on medium or long-term leases.

The fund’s core markets are France, Germany and the UK, but opportunities across the continent will be considered.

A notable initial acquistion is France’s tallest tower, Tour First, in Paris La Défense.

The fund has an initial investment capacity close to €700 million, and has already raised over €500 million from institutions in Europe. In time, the firm aims to increase the fund’s target size to around €5 billion.

Manager Rainer Suter, head of continental funds and separate accounts at Axa IM Real Assets, will be supported by three portfolio managers, based in Cologne, Paris and London respectively.

A spokesperson said investment in core real estate assets will offer long-term income, an ideal solution for institutional investors in the current environment.

AXA IM Real Assets manages assets of more than €50.4 billion.

INFRASTRUCTURE

INFRASTRUCTURE

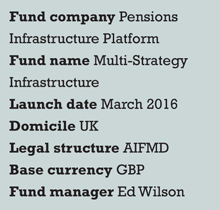

The UK Pensions Infrastructure Platform (PiP) has launched a new infrastructure fund.

With a target size of £1bn, the fund invests directly in UK core infrastructure projects, including transportation, energy (traditional and renewable), utilities, communication, housing and social infrastructure.

In order for smaller pension schemes to participate, the fund has a minimum commitment size that effectively allows schemes of any size to invest and still share the same terms with all other investors.

A co-investment programme is offered to larger, institutional investors, aimed at offering benefits of scale. The fund’s founding investors have already invested more than £1 billion in the fund.

SMART BETA

SMART BETA

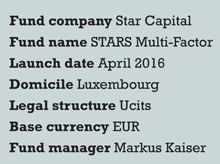

German asset manager Star Capital has launched the STARS Multi-Factor Fund, which invests in factor-driven smart beta strategies to respond to changing market and economic cycles.

The fund’s investment universe is comprised of about 100 smart beta ETFs, providing global and regional exposure to various equity factors, including dividends, share buybacks, value, growth, quality, size, minimum volatility and momentum.

The firm believes factor premiums can generate outperformance against the broader stock market in the long term, and active rules-based risk management will allow for a significant reduction in the maximum drawdown of the equity investment, improving and stabilising the portfolio’s returns in the process.

The fund is authorised for distribution in Germany and Luxembourg, and open to both retail and institutional investors. There is a minimum investment requirement of €100,000.

CATASTROPHE BONDS

CATASTROPHE BONDS

UK-based insurance risk-related asset manager Securis Investment Partners has launched a catastrophe bond fund.

The fund will invest in a portfolio of ‘cat’ bonds, a diversified range of risk-linked securities, exposed to catastrophe event risk (such as natural disasters) in different geographies.

The fund will target a net return of USD Libor plus 4%-5%, with low correlation to more traditional asset classes. An annual management fee aligned to the returns and liquidity available in the current market will be charged, but no performance fee will be levied.

Cat bonds were created in the mid-1990s, in the aftermath of Hurricane Andrew and the Northridge earthquake. If a catastrophe takes place during the term of the bond, investors lose money – the absence of such an event drives its returns.

A spokesperson for the firm said opportunities within the market were growing due to new perils, including terrorism, cyber crime and climate change.

Cat bond performance is generally not impacted by financial market events, such as stock market volatility or interest rate movements.

As a result, such bonds can be a source of non-correlated returns.

TWO YEARS ON

TWO YEARS ON

Two years ago, Swedish asset manager Tundra Fonder launched a dedicated Vietnam fund, the first of its kind available to Scandinavian investors.

The fund uses FTSE Vietnam TR, the benchmark used by the best-performing Vietnamese ETFs, to source equities out of a universe of 700.

Manager Mattias Martinsson then constructs a portfolio of 35-40 stocks, aiming for a maximum fund size of around $25 million.

Since launch, the fund has returned -1.3%, while its benchmark has returned -14.6% over the same period.

The fund has received positive returns in all sectors except for financials, which have struggled since 2008/9, and were further impacted by China’s slowdown last year.

Vietnam was still recovering from the financial crisis when the fund was launched. However, the country enjoyed GDP growth of 6% in 2014, and is forecast to exceed that figure in 2015.

Increasingly large numbers of tourists are assisting this recovery, as are manufacturers relocating their operations

from China.

The Vietnamese government also intends to relax foreign ownership restrictions on listed businesses this year.

©2016 funds europe